Raising your seed round: why size doesn't matter

If you’re in a MENA-based startup, and you’re reading this article on LinkedIn, then you’ve come across dozens of headlines about Arab startups raising double digit seed and series A rounds in 2021. It would make sense, since 2021 was MENA’s record breaking year in term of startup VC funding, at a whopping $2.6B invested into the region.

In 2019, our previous venture - called Addenda - raised a humble ~650,000 dollar seed round. To say it took some time would be an understatement. We signed our first angel investor in April of that year, and spent a few more months gathering more small tickets from serial entrepreneurs, niche VCs, and insurance enthusiasts. The round was quietly closed in November 2019 with 500 Startups as the lead VC. Back then it was incredibly difficult to get one of the older regional VCs (IYKYK) to even respond to your emails.

In contrast, just last month I met a lovely two-person, pre-product UAE startup that is about to close a 6 figure seed round at a 15+ million dollar valuation. Don’t get me wrong, the founders are brilliant and I couldn’t be happier for them, but we need to address the elephant in the room: what constitutes a seed round is changing really fast.

For every startup raising 5 million dollars in seed funding, there’s several seed stage founders who don’t want to announce their rounds because they weren’t large enough. Plenty of startups raised $25k to $100k from accelerator programs, and some founders may feel goofy about announcing that money as a “seed” stage investment. I’ve also recently met a few founders who complained about raising small pre-series A rounds despite healthy MoM revenues and a product market-fit. If you’re one of those founders, this post is for you.

The size of your funding round doesn’t matter.

I plead guilty. I drafted an entire article because of an innuendo I thought of in the shower, but there is merit to the title. A 2017 article by Tech Crunch titled “Does it really matter how much your startup raises?” identified that dollar value of seed stage funding only marginally affected the success rate of series A startups. Further, seed round sizes above 2.5 million dollars had no noticeable effect on the success and size of series B rounds.

There’s a German saying that goes like “Die dümmsten Bauern, haben die größten Kartoffeln”, which roughly translates to “the dumbest farmers have the biggest potatoes”. Raising large rounds is the easy part. Building a successful business is what is actually difficult.

The metrics that actually matter

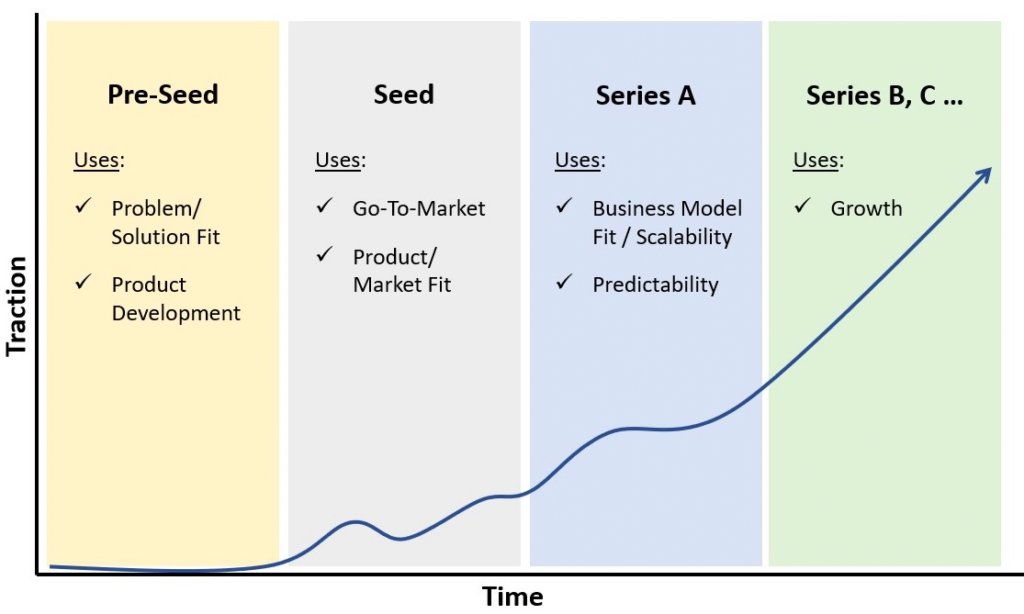

If you’re a serial entrepreneur, the below may not relate to you. If you are, however, seeking fundraising for the first time ever, or if you’ve recently closed a small seed round, you should consider the following: realistically, you do not need more capital than you anticipate spending in the next 12 months. Further, that spend should focus on a certain milestone like your number of customers, return on ad spend, or revenue. If you want to play it safe, budget for those 12 months, and add a 3-month buffer. Feeling lucky? Add another 3-month buffer, and that’s how much you need to raise for your seed stage round.

Identify the KPIs (or OKRs or whatever) that matter to you, fundraise just enough to hit those each round, and venture capital may just flow your way. If others raising large rounds is what’s leading you to consider bigger tickets, ignore the noise, execute, and double down on your milestones.

Bigger tickets mean bigger expectations for exits

Investors aren’t necessarily in-love with your charisma or your idea when they offer you a big ticket. Their minimum ticket size may be large, or they may want to hedge their bets against your incumbent competitors, or they might just have unrealistic expectations of your company’s exit value relative to your actual target market.

Be mindful that the likelihood of startups closing shop between seed stage and series A is already low. A seed stage startup overcapitalizing their round may lead to an inflated valuation, astronomical investor expectations, and immense pressure to meet certain milestones before you’ve even validated your idea.

I’m not an economist. I don’t know what made a tepid market in 2019 flip into a hot region in 2021. All I know is that MENA startups have been receiving funding at earlier stages more than ever before. I also know that those investments are de-risking and democratizing access to an unconventional asset class, and in the process raising salaries, creating more jobs, making the lives of millions of consumers better, and giving regional regulators a much needed push.

It’s all fun and games until it’s not

I still wonder about the inflating seed stage valuations relative to our nascent region’s average income, inconsistent regulation, and geopolitical landscape. I hope more capital flows into disruptive early stage ventures, and I hope more and more talent sprouts from the Middle East. All I have to say is if you’re fundraising at a steep valuation for your seed round, also take into account that you may have a tough time raising your next round once the world economy slows down again.